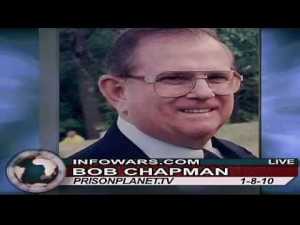

Bob Chapman

The international Forecaster

April 2, 2010

Source : http://www.infowars.com/failed-banks-and-failed-billions

Bubbles have a hard time coming to an end, especially in residential real estate. Underlying forces such as government intervention to prolong the agony and the abject stupidity of builders extends the bubbles. We are in a vast home inventory expansion and builders are going to build 535,000 new homes. The projected foreclosure rate could give us as much as a 3-year home inventory, up from present levels of about a year, if one includes the lenders shadow inventory. This past week the home building index rose 7.1% and it is up 25.1% year-to-date. The retail index rose 17% y-t-d, yet unemployment stubbornly clings to 22-1/8%. In fact, the retail index is up 87.4% y-o-y. We would say that index is grossly overpriced. As you can see bubbles have a way of not wanting to die quickly. This is caused by man’s disparately wanting to cling to the past attempting to take the easy way out rather than adapting to change. Government tries to keep sections of the economy alive rather than letting the cleansing process take its course. The subsidization of the housing market is doomed to failure, because there simply isn’t enough money and credit available to keep it going indefinitely. All government is doing is re-flating a dying bubble. These Socialistic/Marxist policies just won’t work. Whether government likes it or not interest rates are headed higher, probably by 1% or more by the end of the year as government in its quest for more money to cover its debts crowds most others out of the market. This can be accommodated by the Fed, but not without higher inflation or perhaps hyperinflation, which in turn will drive interest rates even higher. We are seeing the reigniting of speculative mania in other markets as well – in the stock market and particularly in the low quality sector of the bond market worldwide. The mis-pricing of investments and finance is resulting in terrible distortions, mostly the result of Fed and government policy.

This mania has been aided and abetted by US dollar strength, especially over the past two months. We saw JPMorgan Chase, Goldman Sachs and Citigroup and others loading up on the long side of the dollar starting last October between USDX 74 and 78. They obviously knew the Greece episode was on the way. Irrespective, and in spite of no positive fundamentals, dollar strength was used to draw funds into dollar denominated assets. Supposedly the dollar has some sort of competitive advantage, which it doesn’t, and that a strong dollar will be re-flationary, which it has been. Gold and silver should have been flying to the upside, but our government detests free markets and it again temporarily suppressed prices. This is the result of the machinations of Larry Summers and Tim Geither. Dollar strength has the perceived benefit of the Fed’s ability to endlessly create money and credit.

It is this perception added to Greece, European and euro problems that have fueled speculation in world markets. Perceptions are one thing, and fundamentals are another more powerful force, which in time will reassert themselves. Problems will first be evident in the bond markets, which have already begun. As soon as the 10-year T-note solidly crosses 4% the market, the dollar and bonds will falter. The current strength is perceived to be the weakness of other currencies and their economies, prospective re-flationary policies and the concept of too big to fail. This is why there is the concept that the current “recovery” will persist. They also recognize that individual euro zone countries cannot inflate their way out of problems. One currency prohibits that from happening. This means Greece and others cannot monetize their debt and that means any kind of recovery is years away. All 19 near bankrupt countries are in the same boat except the US. Markets believe in the Bernanke put or backstop. They also believe the Fed will reinflate again. They would rather have inflation or hyperinflation, which they can in part control, rather than deflation, which once it begins cannot be contained.

Then enters the question will the Fed deliberately choose deflation in a year or two to bring about world government? Is this what Greece was all about? We do not know for sure. All we can do is guess. Do not forget Europe’s problems are not as bad as those of the US even though they are led to believe they are.

The 10-year Treasury note may well be telling us something and that is that higher rates are on the way. It certainly doesn’t auger well for any recovery. If credit spreads widen watch out. Such a development would mean the dollar would begin to retrace its recent gains. Dollar gains are over at 82 on the USDX. We await its correction.

We have spent more than 70 years as Americans and we gasp at the criminal enterprise that America has become. Lawbreaking has become as casual as running a business, whether it is on Wall Street or within the beltway in Washington. Worse yet, almost all malefactors never see the inside of a jail, they just have their corporations pay fines and go back to doing what they were doing, which was breaking the law.

One of the ultimate insults comes from the FDIC requesting donations. 200 to 500 banks will fail this year because of incompetence and terrible investments. We believe, as the year progresses, bank failures will explode. One of the factors leading us to this conclusion is that more than 1,000 banks have professionals overseeing bank operations from the Comptroller of the Currency’s Office. Worse yet, we are seeing many banks and credit unions telling depositors they may have to wait seven days or more for their money. Can bank holidays be far behind? We believe it will happen over the next couple of years.

As we go forward we continue to see massive Treasury purchases by the Fed. The monetization is spellbinding at somewhere between 50 and 80 percent. The more we look at this cartoon the more we know quantitative easing cannot stop. If it does the system will collapse. The Fed and the FDIC even want pension funds to buy their toxic garbage, as does Fannie Mae and Freddie Mac. What a sordid turn of events, but not unexpected considering what we are dealing with.

Unemployment sticks at 22-1/8% as tax revenues continue to plunge as the budget deficit heads toward Mars. The next administration push will be to legalize illegal aliens. You ask where will this all end? Can you believe builders have been buying CDOs? Lennar has plunged in and Orleans fell into insolvency with 20% of their assets in toxic garbage.

There is no question zero interest rates, unbridled government deficits, stimulus plans and the Fed’s quantitative easing have been a failure. The result normally would be to pump more aggregates into the system. We will have to see what the Fed, Congress and the administration do, especially between now and the election. Is it any wonder we have called for a two-third’s official dollar devaluation and a debt default. Be patient we should see them happen within two years. Maybe we will get lucky and get tariffs on goods and services. That way we can bring most of our jobs back and get a healthy economy back with 5% unemployment. Many credit derivatives will be banned as well. We have been involved in markets for 50 years and we know sooner or later those who are leveraged – or on margin – lose sooner or later. As a broker we never had margin accounts. The halt in the downward fall of economics, finance and stock market prices are but an interlude. There are still no solutions, so the downside will begin anew. One thing that has come out of the foregoing and the recent troubles in Greece and with the euro is that gold has been recognized as money, as a currency. That view is going to grow as gold trades higher and higher. As an example, just look at the value of gold in euros and all other currencies. Gold has consolidated time after time at $1,050 to $1,100 no matter what the US government threw at the gold market. There have been a few exceptions to gold’s strength, but over time all currencies will fall against the only real money. On the short-term do not forget the government is very short gold and silver on the Comex, probably the LBMA and most certainly in the producer shares. This week’s numbers will give us an indication whether they have begun to cover. We are going to also see a resumption of inflation officially in the next CPI figures. Real inflation is again approaching 8% and this inflation will be reflected in gold and silver prices. Not all professionals are dumb enough to believe official figures. On the downside we do not believe $1,050 to $1,100 will ever be broken again. Your gains when they come will be quick and large.